- Home Page

- 8 Insurance Selling Tips

- Insurance Presentation and Selling Skills.

Insurance Presentation Selling Skills

Learn how the relationship building concept can increase your life insurance sales.

Every article on this website is like a mini-training school. use the nav bars on either side of this page to locate your area of interest or subject you need help with.

What’s So Difficult About Selling Life Insurance?

What’s

So Difficult About Selling Life Insurance?

Article # 5

Written By John Lensi, CLU, ChFC, RHU, REBC, CMFC, LLIF

and Ted Wolk, website author

The presentation and selling skills of all insurance agents is something that continues to be refined through concept selling and painting word pictures.

Lets examine the several selling skills you need to perform at each step, starting with the opening face-to-face sales interview:

- protection needs analysis

- prioritizing and presenting client recommendations

- closing the sale

- And finally policy delivery (sitting down with the client and re-confirming why product solution address client’s objectives) which I feel is about 15% of a producers overall success in this business.

Most

producers are fairly competent in

this presentation and selling skills set – although after observing and personally conducting in

the area of several thousand sales interviews, plenty of room for

improvement exists in our industry (myself included). especially n the areas of concept selling and painting word pictures.

The key

phase of the sales interview I have seen most often short

changed, is

the fact-gathering phase. This is where the true “close”

in selling

life insurance takes place. Show me a fully completed fact-finder, and

a

quality sale more often than not took place.

Surprisingly, quite

often the veteran

sales person tends to short change this phase

frequently. Having seen “this situation many times

before”, veteran

sales people ‘in error’ often jump to the solution for

the

client’s

life insurance problem.

Although often the protection need is

quite apparent to the producer, its not so

apparent to the layperson

who’s patiently listening and silently wondering “why is

this sales

person recommending the purchase of this particular policy … I don’t

see the connection to what I need” ... “besides, this sales person

doesn’t know me all that well (partially completed fact-finder), so it

seems to me that he/she is

just trying to sell me an insurance policy”.

TWO DIVERSE SALES PROCESSES.

the two most important parts of you sales presentation and selling skills need to be polished and refined. They are the art of properly listening and fact finding.

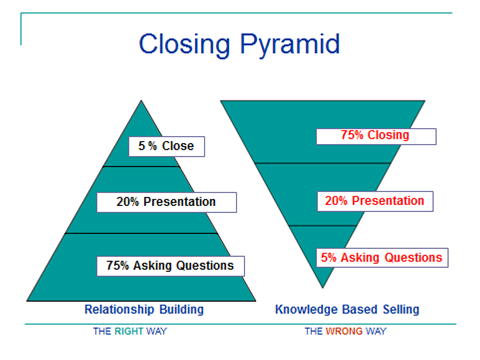

The diagram below illustrates the two diverse sales processes. The triangle represents the amount of time – same amount for two diverse sales approaches – spent on a sales interview with a prospect.

The ‘transnational’ sales person - illustrated on the left in the above

pyramid - short

changes the sales interview

during the fact-finding phase. Consequently, the amount of time needed

in the “closing” phase is a great deal more complicated and time consuming than the ‘relationship-based’

sales person.

Typically

these are sales people who attempt to gain

clients through “convincing” the consumer how good their company’s

product is – usually through a detailed and

time-consuming review of a

computer generated product illustration.

The relationship-based sales financial professional is illustrated on the right in the above pyramid. This sales professional spends sufficient time in the fact-finding phase by getting to know the client’s dreams, goals, and desires – along with the financial position of the client.

This style sales process will almost always lead to a higher closing ratio, better persistency, an easier time closing the sale, and will always result in quality referrals, as well as being able to develop and get repeat or multiple product sales with the client.

Learn how to use the most powerful tool to make this proven relationship-based sales concept work. it will help you make more money selling insurance and help solve your closing problems.

this article on presentation and selling skills probably needs to be reviewed by you at least several times, and you should write down key points that may help.

THE RIGHT WAY AND THE WRONG WAY TO CLOSE A SALE

in closing, we can now see that there are two types of agents when it comes to closing the sale:

- The Quality Fact-Finding Agent Uncovers and Creates The Need by properly asking probing questions.

- the "relationship based financial professional" - helps customers buy.

2.The Product Closer tells the prospect how great the company is and how great the product is. (simply sells features of the policy)

- The “transnational” sales person - sells product and company.

As an agent evolves in the life insurance business, they will learn that the "relationship based financial professional" closing technique is the most effective insurance selling skill to use.

Learn and Earn

Get your Mastering the Art of Closing a Sale e-book today. It is a complete and organized format of the many articles on our site, plus much more. It is a great new agent training tool. Agency managers are using this to help train new agents.

| Monthly Newsletter Free Please add me to your e-mail list so I can receive all new updates on selling and recruiting. See all back issues |

| Insurance Forum Get answers |

Follow Us

|

Our most popular Self Help e-books Exclusive to our readers |

Looking for proven and tested recruiting concepts. View our Agency Building Manual. |

| More free resources and helpful selling tools |